Blue Hydrogen Market Volume Worth 15.60 Million Tons by 2035

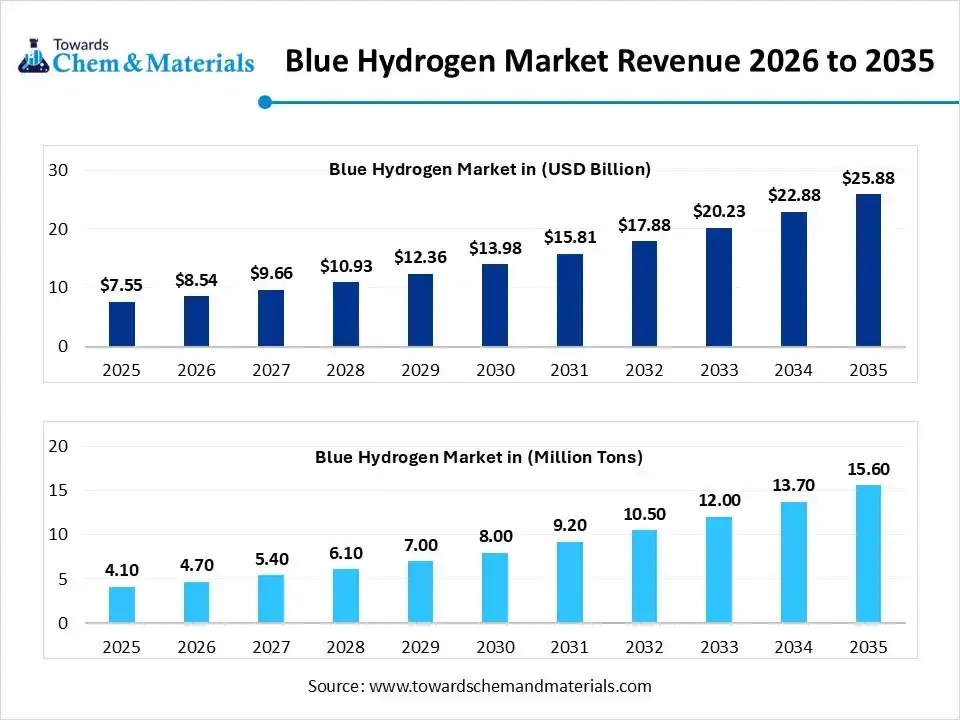

According to Towards Chemical and Materials, the global blue hydrogen market volume was valued at 4.10 million tons in 2025 and is expected to be worth around 15.60 million tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 14.30% over the forecast period from 2026 to 2035.

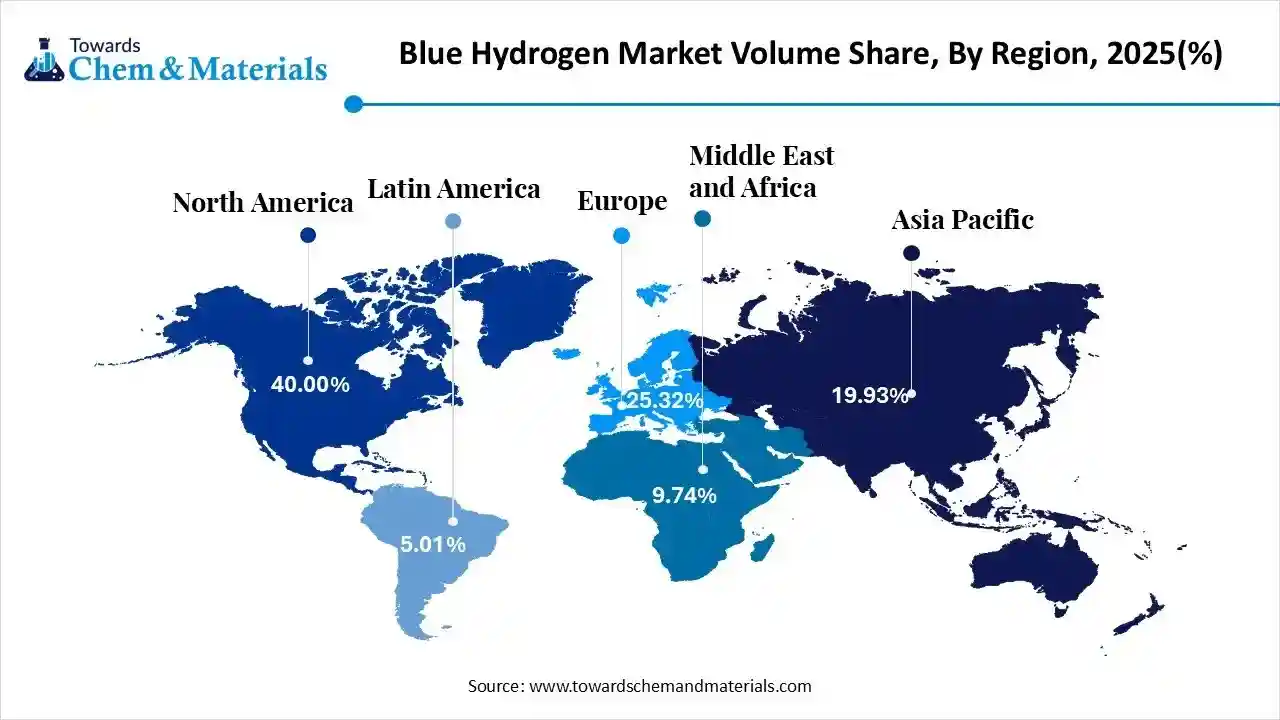

Ottawa, Jan. 20, 2026 (GLOBE NEWSWIRE) -- The global blue hydrogen market size was estimated at USD 7.55 billion in 2025 and is expected to increase from USD 8.54 billion in 2026 to USD 25.88 billion by 2035, growing at a CAGR of 13.11% from 2026 to 2035. In terms of volume, the market is projected to grow from 4.10 million tons in 2025 to 15.60 million tons by 2035. growing at a CAGR of 14.30% from 2026 to 2035. North America dominated the blue hydrogen market with the largest volume share of 40% in 2025. The market is driven by rising decarbonization goals, supportive government initiatives, technological advancement with strategic infrastructure development, and increasing demand from refineries, chemical, and power generation. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6127

What is Blue Hydrogen?

Blue hydrogen is a process of natural gas reformation with steam, integrating with carbon capture and storage technology, which produces hydrogen and reduces carbon emissions. A primary focus drives the rising demand for blue hydrogen to reduce the carbon footprint to meet the net-zero commitment. The viability of blue hydrogen is supported by factors such as the cost-effectiveness of natural gas & carbon capture technologies, innovation, and its application in refining and chemical production.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Blue Hydrogen Market Report Highlights

- By region, North America led the blue hydrogen market held the volume share of around 40% in 2025. The region's large-scale investments drive the growth of the market.

- By region, Asia Pacific is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The growth of the market in the region is driven by rapid industrialization.

- By technology, the steam methane reforming segment led the market with the largest volume share of 75% in 2025.The growth of infrastructure development and production technology drives the growth.

- By technology, the auto thermal reforming segment is projected to grow at a CAGR between 2026 and 2035. The improved carbon capture integration drives the growth.

- By end use, the petroleum refineries segment led the market with the largest volume share of 45% in 2025. The regulatory pressure and other advanced processing drive the growth of the market.

- By end use, the chemical industry segment is projected to grow at a CAGR between 2026 and 2035. Rising demand for low-carbon chemicals increases the demand.

- By transportation, the pipeline segment accounted for the largest volume share of 55% in 2025. Cost-effectiveness and a scalable method increase the demand.

- By transportation, the cryogenic liquid tankers segment is projected to grow at a CAGR between 2026 and 2035. The flexibility and support of cross-border support the growth of the market.

- By generation, the captive segment dominated with the largest volume share of 60% in 2025. Reduced transportation cost and better integration fuels the growth of the market.

- By generation, the merchant segment is projected to grow at a CAGR between 2026 and 2035. Long-term agreements and government initiatives drive the growth of the market.

Blue Hydrogen Market Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 8.54 Billion / 4.70 Million Tons |

| Revenue Forecast in 2035 | USD 25.88 Billion / 15.60 Million Tons |

| Growth rate | CAGR 13.11% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Technology (Production Method), By Generation Method, By Transportation & Storage Mode, By End-Use Application, By Region |

| Key companies profiled | Air Products and Chemicals, Inc. (USA), Linde plc (Ireland/USA), Shell plc (UK/Netherlands), BP plc (UK), Air Liquide (France), ExxonMobil Corporation , Saudi Aramco , Equinor ASA , TotalEnergies SE , Technip Energies N.V. , Siemens Energy AG , Mitsubishi Heavy Industries, Ltd. , Topsoe A/S , Engie S.A. , Uniper SE , Suncor Energy Inc. , Woodside Energy Group , Chevron Corporation , Reliance Industries Limited , Iwatani Corporation |

Major Government Initiatives for Blue Hydrogen:

- United States: Regional Clean Hydrogen Hubs (H2Hubs) — Managed by the U.S. Department of Energy, this initiative allocates $7 billion to develop several hubs, including the Appalachian and Gulf Coast hubs, specifically focused on blue hydrogen production from natural gas.

- Canada: Clean Hydrogen Investment Tax Credit (CHITC) — The Government of Canada provides a refundable tax credit of up to 40% for clean hydrogen projects, with specific eligibility for blue hydrogen that meets strict carbon intensity thresholds.

- European Union: Low-Carbon Fuels Delegated Act — Finalized in late 2025, this regulatory framework provides the necessary legal clarity for the production and certification of "low-carbon" (blue) hydrogen to help meet industrial decarbonization targets alongside green hydrogen.

- United Kingdom: Low Carbon Hydrogen Business Model — The UK Government uses a "contracts for difference" style mechanism to provide price support for blue hydrogen projects, such as the H2H Saltend plant, to ensure they are competitive with natural gas.

- Japan: Basic Hydrogen Strategy Update — Japan's updated strategy focuses on establishing a "hydrogen society" by subsidizing the technology-neutral import of low-carbon hydrogen, with a heavy emphasis on blue ammonia and hydrogen supply chains from Australia and the Middle East.

- Norway: Longship CCS Project — A flagship state-funded initiative that provides the critical carbon capture and storage infrastructure (Northern Lights) required for large-scale blue hydrogen production from Norway's vast natural gas reserves.

- United Arab Emirates: National Hydrogen Strategy 2050 — The UAE Ministry of Energy and Infrastructure aims for the UAE to be a leading global producer by 2031, utilizing its existing gas infrastructure to scale blue hydrogen production for export to Europe and Asia.

- Netherlands: SDE++ Subsidy Scheme — This operating grant from the Netherlands Enterprise Agency provides financial support for large-scale blue hydrogen projects by covering the price difference between conventional grey hydrogen and the cost of carbon capture and storage.

Major Market Trends in the Blue Hydrogen Market

- Decarbonization Efforts: To achieve a net-zero future, the industry is increasingly demanding low-carbon energy that promotes investment in infrastructure and technological innovation.

- Government Energy Transition Initiatives: Government regulation and policies supporting hydrogen as a part of the energy transition to integrate hydrogen into the industrial sector and accelerate global deployment.

-

Growing Industrial Applications: Industry contributing expansion of hydrogen economy in diversified industrial applications, especially in ammonia production, refining, and steel manufacturing serve a crucial feedstock.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6127

Blue Hydrogen Market Segmentation Insights

Technology Insights

How did the Steam Methane Reforming Segment dominate the Blue Hydrogen Market in 2025?

The steam methane reforming segment is the leading market, driven by a large-scale production method due to its cost-effectiveness and compatibility with existing natural gas infrastructure. Retrofitting facilities with sophisticated carbon capture systems allows significant emissions reduction while maintaining operational reliability, offering a scalable pathway to decarbonize heavy industries like ammonia synthesis and petroleum refining to meet rising global demand for low-carbon energy.

The auto thermal reforming segment is anticipated to grow fastest during the forecast period due to its superior efficiency in carbon capture emissions, and enable total capture of process gases. Industries are adopting this technology because of its suitability for new large-scale plants, due to its compact design and self-sustaining heat. It aims to revolutionize the global hydrogen economy, offering efficient decarbonization pathways for heavy industries for decarbonization.

Transportation Insights

Which Transportation Segment Dominates the Blue Hydrogen Market in 2025?

The pipeline segment maintains its market dominance. Hydrogen pipelines are key for transporting large volumes of gas efficiently, with the potential to repurpose existing natural gas networks and develop dedicated systems connecting producers to industries, pipelines offering a cost-effective long-distance transport, providing large-scale refinery and chemical operations by playing a vital role in the distribution of hydrogen.

The cryogenic liquid tankers segment offers significant growth during the projected period, crucial for long-distance, overseas distribution. They enable liquid hydrogen transport at high density, vital for regions lacking pipeline infrastructure. Expanding liquid transport supports logistical flexibility, global hydrogen trade, connecting production hubs to provide a secure and cost-effective solution that fostering a global hydrogen economy.

Generation Insights

How did Captive Segment Dominate the Blue Hydrogen Market?

The captive generation segment dominated the market due to industrial operator demand for on-site production with reliable supply, operational control in the manufacturing process, and eliminating logistical complexities and costs in refineries and chemical plants. This segment manages carbon intensity with its self-sufficient approach towards low-carbon energy.

The merchant segment is set to experience the fastest growth, driven by a rise in specialized energy providers for low-carbon hydrogen with diverse demand from third-party industrial and commercial consumers. By leveraging economies of scale and flexible distribution networks, merchant producers are accelerating adoption and transforming industrial feedstock into an accessible commodity for the clean energy transition.

End-Use Insights

How did the Petroleum Refineries Segment hold the Largest Share of the Blue Hydrogen Market?

The petroleum refineries segment leads blue hydrogen adoption, are the main end-user, providing massive amounts of high-purity hydrogen for processes like hydrocracking and desulfurization, crucial for reducing transportation fuel carbon emissions to meet stricter environmental regulations. Using blue hydrogen, they leverage existing onsite infrastructure and an integrated supply chain to achieve decarbonization, supporting large-scale projects and expanding carbon capture and storage networks.

The chemical industry segment is an emerging segment projected to grow at a CAGR between 2026 and 2035. Driven by high demand for ammonia and methanol, which serve as building blocks for fertilizers and polymers. Decarbonizing supply chains by adopting blue hydrogen provides a scalable and cost-effective way to lower emissions while supporting large production volumes. Hydrogen's dual role as a clean energy source and chemical feedstock makes it vital for sustainable manufacturing.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6127

Blue Hydrogen Market Dynamics

Driver

Investment in hydrogen infrastructure is a key driver of the blue hydrogen industry. The investment is enhancing the reliability of hydrogen supply chains and the transition to hydrogen-based solutions. The government and private sectors are driving robust infrastructure to support production by developing hydrogen hubs, storage, and distribution of blue hydrogen.

Restraints

Blue hydrogen provide viable bridge to a low-carbon economy, but the market is restrained significantly due to high production costs, infrastructure gap, CCS technology limitation, competition from green hydrogen despite its growth potential and industrial uptake. These key restraints limit its adoption.

Market Opportunity

Refineries are increasingly investing in blue hydrogen production, which create significant opportunity for advanced steam methane reforming (SMR) catalysts that are optimized for high-purity hydrogen output with lower energy intensity by operating efficiency within carbon-capture-integrated systems that drive the demand.

Can Technological Advancement in the Blue Hydrogen Market Propel Industrial Production?

The technological innovation in the hydrogen production process is driving the industry. Advances in carbon capture and storage technology enhance the efficiency of blue hydrogen production and improve the viability of this technology. Overall, technological shift lowers production costs and result in a reduction in greenhouse gas emissions with improved operational efficiency.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Regional Insights

How did North America Dominate the Blue Hydrogen Market?

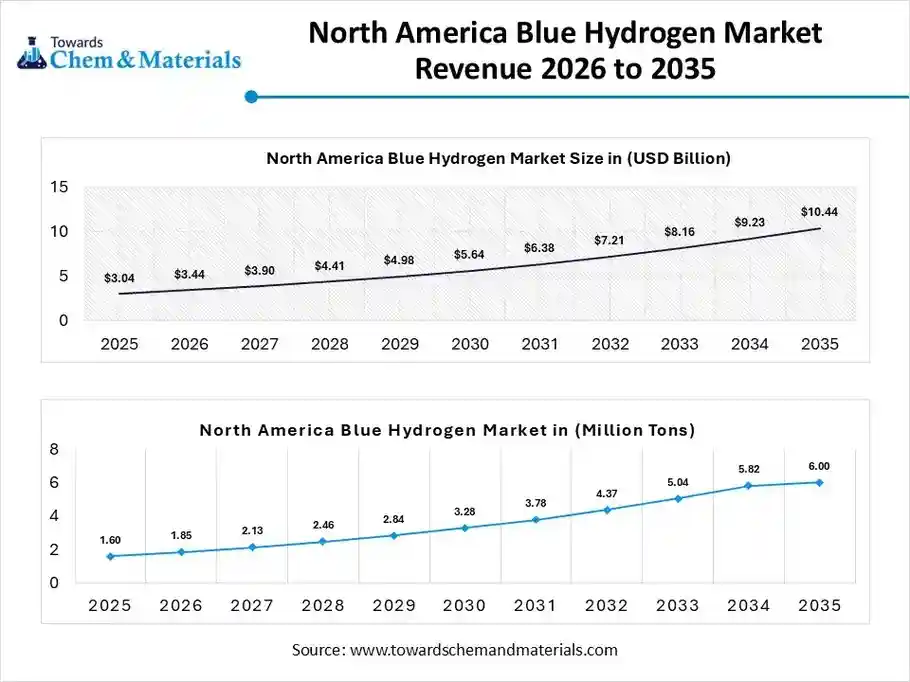

The North America blue hydrogen market size was valued at USD 3.04 billion in 2025 and is expected to be worth around USD 10.44 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 13.13% over the forecast period from 2026 to 2035. The North America blue hydrogen market volume was estimated at 1.60 million tons in 2025 and is projected to reach 6.00 million tons by 2035, growing at a CAGR of 14.42% from 2026 to 2035. North America dominated the market with a volume share of approximately 40% in 2025.

North America is a global leader in the market by leveraging its large, low-cost natural gas reserves and cutting-edge pipeline infrastructure. Its competitive advantage grows through the integration of Carbon Capture and Storage (CCS) with established Steam Methane Reforming (SMR), enabling large-scale and economically viable production. National policies like the U.S. National Clean Hydrogen Strategy and Canada’s hydrogen strategy provide tax credits and funding, boosting regional hydrogen hubs. Heavy industries such as petroleum refining and chemicals are adopting blue hydrogen to meet decarbonization targets.

U.S. Blue Hydrogen Market Trends

The U.S. market is growing rapidly as companies and energy providers increasingly leverage abundant natural gas reserves and carbon capture, utilization, and storage (CCUS) technology to produce lower-carbon hydrogen at scale. Federal incentives, including tax credits for clean hydrogen production and carbon capture, are driving investment and making blue hydrogen more competitive with traditional fossil fuels, while large projects along the Gulf Coast and Midwest aim to boost production capacity.

Why is Asia Pacific the Fastest-Growing Region in the Blue Hydrogen Market?

Asia-Pacific is an emerging region by becoming a major growth driver in the cleaner energy transition, focusing on decarbonizing heavy manufacturing through advanced carbon capture integrated into existing fossil fuel infrastructure. Strong government support and investments in energy hubs foster innovation and infrastructure expansion. As energy demand upsurges and climate goals tighten, blue hydrogen acts as a vital, scalable, and cost-effective alternative to reduce emissions and ensure long-term energy security.

China Blue Hydrogen Market Trends

China's market is projected to grow strongly through the end of the decade, with estimates showing a double-digit compound annual growth rate driven by expanding industrial demand and government support for low-carbon hydrogen production. The expanding use of blue hydrogen in heavy industries such as power generation, chemicals, and refining, often integrated with carbon capture and storage (CCS) infrastructure, supports broader decarbonization goals in energy-intensive sectors.

More Insights in Towards Chemical and Materials:

- Liquid Hydrogen Market Size to Hit USD 91.21 Billion by 2035

- Green Hydrogen Market Size to Surpass USD 413.20 Billion by 2035

- Biohydrogen Market Size to Surpass USD 157.80 Million by 2035

- Asia Pacific Green Hydrogen Market Size to Hit USD 109.19 Bn by 2034

- Europe Green Hydrogen Market Size to Surge USD 147.88 Bn by 2034

- U.S. Green Hydrogen Market Size to Reach USD 6,993.64 Mn by 2034

- Iron and Steel Casting Market Size to Hit USD 320.07 Bn by 2035

- Aviation Fuel Market Size to Hit USD 841.99 Billion by 2035

- Sodium Ion Battery Material Market Size to Hit USD 40.74 Bn by 2035

- Textile Colorant Market Size to Hit USD 18.46 Billion by 2035

- Polyester Fiber Market Size to Hit USD 274.58 Billion by 2035

- Lithium Metal Battery Materials Market Size to Hit USD 32.48 Bn by 2035

- Petrochemical Recycling Market Size to Hit USD 53.08 Billion by 2035

- Plastic Waste Pyrolysis Oil Market Size to Hit USD 1,365.54 Mn by 2035

- Chemical Recycling of Plastics Market Size to Hit USD 47.60 Bn by 2035

- Natural Gas Liquid Market Size to Hit USD 50.06 Billion by 2035

- Bioplastic Textiles Market Size to Hit USD 34.53 Billion by 2035

- North America Industrial Liquid Waste Management Market Size to Surpass USD 19.89 Bn by 2035

- Bioplastics In Medical Devices Market Size to Surpass USD 6.73 Billion by 2035

- Bioplastics in Diagnostic Devices Market Size to Hit USD 879.46 Million by 2035

Top Market Players in the Blue Hydrogen Market & Their Offerings:

Tier 1:

- Linde plc (Ireland/USA): Provides integrated hydrogen production and carbon capture technology, recently investing $1.8 billion to supply blue ammonia to industrial customers in the U.S. Gulf Coast.

- Air Products and Chemicals, Inc. (USA): Building a landmark $4.5 billion blue hydrogen complex in Louisiana that will capture and permanently sequester 95% of its carbon emissions.

- ExxonMobil Corporation: Developing one of the world's largest blue hydrogen plants at its Baytown, Texas facility to decarbonize its own operations and supply low-carbon fuel to heavy industry.

- Saudi Aramco: Leveraging its vast gas reserves to become a leading exporter of blue ammonia and hydrogen, with a target to produce 11 million tonnes per year by 2030.

- Uniper SE: Focusing on the transformation of power plants and the development of "H2Hubs" in Germany to import and produce blue hydrogen for the European energy grid.

- Equinor ASA: Leading major European decarbonization efforts through projects like H2H Saltend, which converts natural gas to hydrogen while storing CO2 under the North Sea.

-

TotalEnergies SE: Decarbonizing its global refinery network by retrofitting existing hydrogen production units with carbon capture and storage technology.

Tier 2:

- Technip Energies N.V.

- Siemens Energy AG

- Mitsubishi Heavy Industries, Ltd.

- Topsoe A/S

- Engie S.A.

- Shell plc (UK/Netherlands)

- BP plc (UK)

- Air Liquide (France)

- Suncor Energy Inc.

- Woodside Energy Group

- Chevron Corporation

- Reliance Industries Limited

- Iwatani Corporation

Recent Development in the Blue Hydrogen Industry

- In July 2024, Aramco and Air Products Quadra signed a joint agreement to acquire that forces the development of lower-carbon hydrogen production as an alternative energy solution. The production is driven by the support growth of Aramco’s blue hydrogen portfolio. https://www.aramco.com/en/news-media/news/2024/aramco-to-acquire-50-stake-in-air-products-qudras-blue-hydrogen-industrial-gases-company

Blue Hydrogen Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Blue Hydrogen Market

By Technology (Production Method)

- Steam Methane Reforming (SMR) + CCS

- Auto Thermal Reforming (ATR) + CCS

- Gas Partial Oxidation (POX) + CCS

- Methane Pyrolysis (Turquoise Hydrogen)

By Generation Method

- Captive

- Merchant

By Transportation & Storage Mode

- Pipeline

- Cryogenic Liquid Tankers

- Compressed Gas Cylinders

- Geological Storage

By End-Use Application

- Petroleum Refineries

- Chemical Industry

- Power Generation

- Transportation

- Industrial Manufacturing

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6127

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.