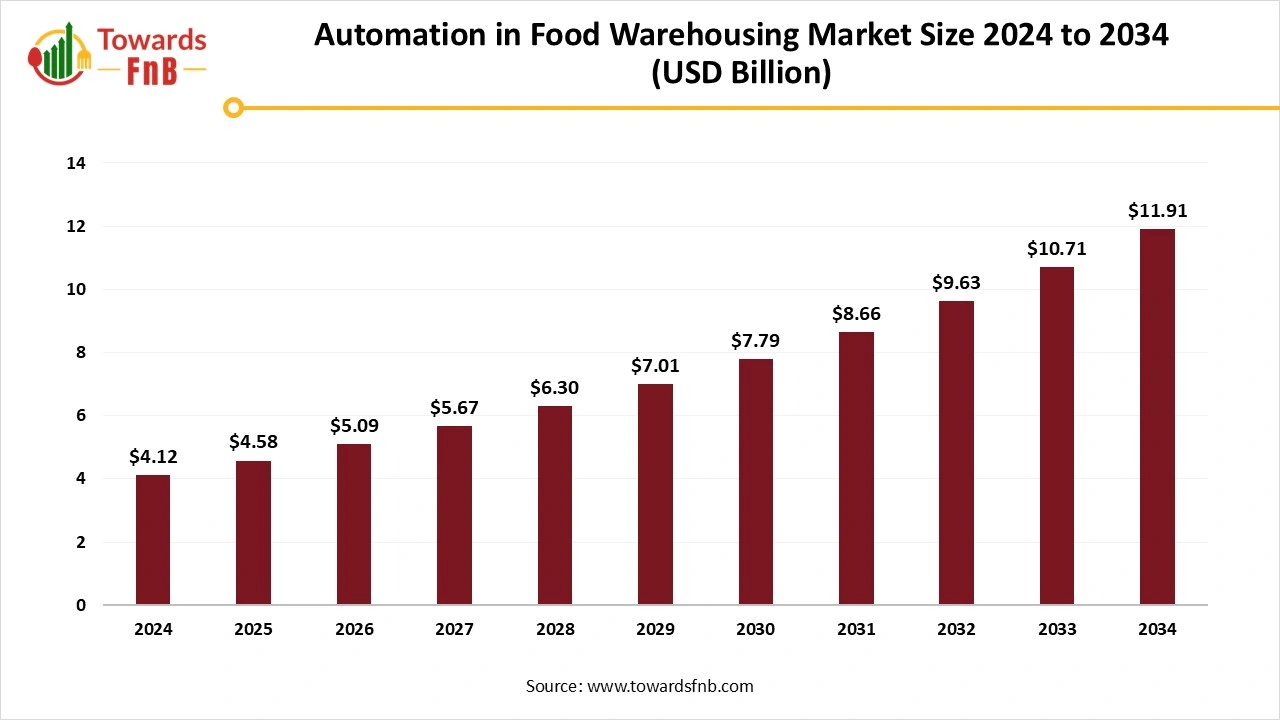

Automation in Food Warehousing Market Size to Exceed USD 11.91 Billion by 2034, Driven by Cold Chain Expansion and E-Grocery Growth

According to Towards FnB, the global automation in food warehousing market size is calculated USD 4.58 billion in 2025 and is estimated to hit around USD 11.91 billion by 2034. The market is projected to expand at a solid CAGR of 11.2% from 2025 to 2034. The surge is powered by labor shortages, cold chain expansion, and the rapid rise of e-commerce grocery fulfillment.

Ottawa, Sept. 16, 2025 (GLOBE NEWSWIRE) -- The global automation in food warehousing market size was valued at USD 4.12 billion in 2024 and is anticipated to increase from USD 4.58 billion in 2025 to around USD 11.91 billion by 2034, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The market is driven by the increasing demand for automation in warehousing, which facilitates easy logistics management and inventory management, as well as the use of technological methods like AI and IoT for seamless tracking and predictive management in response to consumer demands.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5730

Automation in Food Warehousing Market Overview

Automation in the food warehousing industry helps manage food products, ensure their smooth handling, and reduce manual dependence, as well as lower labor costs. Automation also helps to improve the efficiency of operational tasks, further fueling the growth of automation in the food warehousing market. Automation systems such as AS/RS systems and conveyor belts also help to improve the efficiency of the warehouse activities and tasks. The need for temperature-sensitive food handling, the growth of e-commerce platforms, and rising labor shortages are also major factors driving the market's growth.

Key Highlights of Automation in Food Warehousing Market

- By region, North America dominated the automation in food warehousing market in 2024, whereas the Asia Pacific is expected to grow in the forecast period.

- By technology, automated systems and retrieval systems segment led the growth of automation in the food warehousing market in 2024, whereas the robotic picking and packing segment is expected to grow in the foreseen period.

- By warehouse type, the cold storage warehouses segment led the automation in the food warehousing market, whereas the fulfillment centers segment is expected to grow in the foreseeable period.

- By application, the inventory management segment led the automation in food warehousing market in 2024, whereas the order picking and fulfillment segment is expected to grow in the foreseen period.

- By food type, the packaged and frozen food segment led the automation in the food warehousing market in 2024, whereas the meat, poultry, and seafood segment is expected to grow in the foreseeable future.

- By end use, the food manufacturers segment led the automation in the food warehousing market in 2024, whereas the e-commerce grocery platform segment is expected to grow in the foreseen period.

- By deployment mode, the on-premises segment dominated the automation in food warehousing market in 2024, whereas the cloud segment is expected to grow in the forecast period.

Top Automation in Food Warehousing Market Product Survey

| Product / Technology | Key Features / Capabilities | Benefits of Food Warehousing | Typical Use-Cases / Example Applications |

| Automated Storage & Retrieval Systems (AS/RS) | High-density stacking, robotic cranes, or shuttle systems, double-deep or multi-deep storage, handling of pallets/totes, and working in cold/frozen environments. | Saves floor space, reduces labor costs, increases speed & accuracy of picking/storing, good cold chain integrity (less manual handling). | Cold storage warehouses, high-throughput fulfillment, raw materials/packaging inbound and palletized outbound; e.g., Swisslog’s ASRS for raw materials & pallets. |

| Conveyor & Sortation Systems | Automated conveyors, sorters, diverters; integration with sensors & software; handling of totes, boxes, pallets. | Smooth flow of goods, reduced manual handling, controlled speed, fewer errors, and improved throughput. | Moving boxes between zones, sorting by destination, feeding picking stations, and connecting ASRS to shipping docks. |

| Robotic Picking & Packing Systems | Robots/cobots that pick items (even delicate/irregular ones), automated pack-out into boxes or pallets, vision systems, and adaptive end-of-arm tooling. | Increases speed and precision, reduces damage to fragile products, supports high variability in SKUs, and helps address labor shortages. | Grocery fulfillment centers; fresh produce; mixed orders that need careful handling; Ocado’s “On-Grid Robotic Pick” arms packing groceries. |

| Automated Guided Vehicles (AGVs) / Autonomous Mobile Robots (AMRs) | Navigation (laser, vision, SLAM), transportation of pallets/racks/carts, flexibility in routing, and the ability to operate in chilled/frozen/ambient zones. | Reduces forklift traffic & manual transport; improves safety; flexible deployment; works well in cold chain where human operations are harder. | Moving raw materials from receiving to storage, replenishing pickindevelopments, feeding production lines, and supplying packaging materials. |

| Warehouse Management Systems (WMS) & Control Software (including AI / ML / IoT / Sensors) | Real-time inventory tracking, forecasting, and traceability; integration with sensors (temperature/humidity), cloud versus on-premises; analytics; and optimization of layout & workflows. | Better inventory accuracy, compliance with food safety and cold chain protocols, reduced development age, and more efficient use of space & labor. | Monitoring temperature/humidity; optimizing order pick routing; predicting demand; traceability of perishable goods; cold-chain control. |

| Palletizing & Depalletizing Automation | Robotic palletisers, cobots, automated depalletising stations; ability to handle varied pallet patterns/load types. | Speeds up end-of-line operations, reduces manual lifting, improves safety, and achieves better consistency. | At the point of shipment, preparing pallets for transport, depalletizing incoming goods, and handling mixed loads. |

| Temperature Monitoring / Cold Chain Automation | Sensors, automated control of refrigeration, monitoring, alerts; environmental IoT deployed in storage & transit. | Ensures food safety; reduces spoilage; ensures regulatory compliance; and reduces risk of product loss. | Frozen/chilled food storage; transport between zones; compliance with food safety laws; quality assurance. |

| Voice / Light / Guided Picking Systems | Voice-directed picking; pick-to-light; light indicators; wearable devices; sometimes combined with mobile devices/tablets. | Reduces picking errors, speeds up order fulfillment, reduces training time, and improves safety & worker satisfaction. | Order picking in ambient warehouses; grocery fulfillment; high-SKU operations; situations with seasonal or temp/seasonal workers. |

New Trends of Automation in Food Warehousing Market

- Growing technology and automation in food warehousing activities are helping the growth of the market. Technologies such as AS/RS systems, conveyor belts, AI, and ML aid the market’s growth.

- A rising number of micro-fulfillment centers also helps the growth of automation in the food warehousing market by facilitating quicker last-mile delivery and lower shipping expenses.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/automation-in-food-warehousing-market

Impact of AI on the Automation in Food Warehousing Market

Artificial intelligence (AI) is transforming the food warehousing market by enhancing efficiency, safety, and sustainability across storage and distribution operations. Traditionally, food warehousing has faced challenges such as inventory mismanagement, spoilage, and fluctuating demand, but AI is addressing these through predictive and automated solutions. AI-powered demand forecasting models analyze consumption patterns, seasonal trends, and supply chain disruptions to optimize inventory levels, reducing waste and ensuring timely replenishment. In cold storage facilities, AI-driven sensors and IoT systems continuously monitor temperature, humidity, and energy usage in real-time, maintaining ideal storage conditions for perishable goods while minimizing energy costs.

AI-enabled robotics and automated guided vehicles (AGVs) streamline warehouse operations by handling sorting, picking, and packing tasks with speed and accuracy, reducing reliance on manual labor and lowering operational errors. Computer vision systems further strengthen food safety by detecting damaged packaging or labeling errors before distribution.

Recent Developments in Automation in Food Warehousing Market

- In May 2025, the Government of India announced the launch of a new portal to monitor food storage for enhanced safety and quality. The Ministry of Consumer Affairs, Food & Public Distribution made the announcement. (Source- https://ddnews.gov.in)

- In April 2025, Otrium, a Dutch fashion platform, announced the launch of its new automated warehouse named ‘O-Mega Robot’. The company informed that the AutoStore system has up to 400 percent more space compared to traditional warehouses. (Source- https://ecommercenews.eu)

Market Dynamics

What Are the Drivers of Automation in Food Warehousing Market?

The high demand for automation in warehousing activities, driven by the growth of e-commerce platforms, is a major factor contributing to the growth of automation in the food warehousing market. Advanced technology, such as AI, ML, and IoT, helps to manage orders easily and helps with the handling of orders as well, to lower the chances of spoilage. It also helps to mitigate the rising labor costs that are fueling market growth. Technologies such as AS and RS systems help to manage the spaces in limited warehouse sizes, which is helpful to aid the growth of the market.

Challenge

High Investment Costs Are Restraining the Growth of the Market for Automation in Food Warehousing

High investment costs required for the development of automated warehouses are one of the major factors restraining the growth of automation in the food warehousing market. The costs involved for software development, robotics, and infrastructure development restrain smaller and medium-sized businesses from stepping back with traditional warehouses. Hence, such factors act as a barrier to the market's growth.

Opportunity

Technological Advancements are helpful for the Growth of the Market

Technologically advanced methods such as AI, ML, IoT, sensors, and various other techniques are helpful for the growth of the market in the foreseeable period. Industry 4.0 facilitates the automation of the food warehousing industry, enabling efficient tracking and management of packages, as well as the movement of parcels both within and outside the warehouse. The advanced technology is being highly adopted in developing countries like North America and the Asia Pacific.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5730

Automation in Food Warehousing Market Regional Analysis

North America Dominated the Automation in Food Warehousing Market in 2024

North America led the automation in the food warehousing market in 2024 due to the growth of e-commerce platforms preferred by consumers for convenience and ease of shopping. With the growth of online platforms, online retailers must handle a high volume of orders and packages efficiently, leading to the development of automated warehouses. Automated warehouses help to manage the orders efficiently and are also helpful to fulfill the rapidly increasing orders. Robotic pickers, conveyor systems, and ASRS systems help the manufacturers fulfill the orders and manage the supply chain smoothly. It also helps to improve cost-effectiveness.

Asia Pacific is expected to grow in the Forecast Period

The automation technology in the warehouse sector is helping the Asia Pacific grow in the foreseeable future. The automation helps the industry to manage the flow of orders, respond to consumers on time, and lift packages and orders easily without any hassle, with lower dependency on manual labor. Technologies such as AI, ML, and IoT help manufacturers to keep track of their packages, along with their easy management. It also helps to enhance new opportunities in the automation sector.

Automation in Food Warehousing Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 11.2% |

| Market Size in 2024 | USD 4.12 Billion |

| Market Size in 2025 | USD 4.58 Billion |

| Market Size by 2034 | USD 11.91 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Automation in Food Warehousing Market Segmental Analysis

Technology Type Analysis

The automated storage and retrieval systems (AS/RS) segment led the automation in food warehousing market in 2024 due to high demand for automation in warehousing activities. It helps to minimize the labor costs, which is helpful in situations such as labor shortages. It also helps to manage expanding labor costs. It also helps in the automation of product movement inside and outside of the warehouse to lower spoilage and defect chances. The AS/RS system also helps reduce manual labor and automate maximum procedures for time-saving and efficient work.

The robotic picking and packing segment led the automation in the food warehousing market in 2024 due to its high importance for automation in such activities. It helps businesses to manage the rising operational costs and labor costs as well. It also helps to maintain efficiency and avoid the chances of spoilage and product loss observed in manual handling scenarios.

Warehouse Type Analysis

The cold storage warehouse segment led the automation in the food warehousing market in 2024 due to its high demand in various industries such as food and beverages, along with the pharmaceuticals segment as well. The cold storage facility helps to keep the food products safe and avoid spoilage. It helps to maintain their shelf life and allows consumers to receive fresh and healthy products. The facility is essential for storing various food products, including fresh fruit and vegetables, frozen items, probiotics, and multiple other products. The segment has also observed growth due to the high demand for frozen food by consumers from different age groups.

The fulfillment centers segment is expected to grow in the expected timeframe due to high demand for e-commerce platforms providing different types of products on a single platform. It helps e-retailers manage their goods and services without the need for physical stores to store their products. It also allows the online retailers to manage their products and delivery tasks smoothly without the presence of a physical warehouse.

Application Type Analysis

The inventory management segment led the automation in the food warehousing market in 2024 due to high demand for automation for managing warehouse products and tasks. It helps to enhance efficiency and precision, along with lowering labor costs as well. Technologically advanced methods such as RFID tags, AMRs, environmental sensors, and unified WMS systems help to improve efficiency, precision, and lower the time to manage products and various tasks easily.

The order picking and fulfillment segment is expected to grow in the coming years due to the growth of e-commerce platforms. Automation in warehouse activities also helps to lower lifting time and response, manage goods efficiently without any spoilage, and enhance order fulfillment as well.

Food Type Analysis

The packaged and frozen food segment led the automation in food warehousing market in 2024 due to the high demand for frozen and convenient food options to aid the hectic lifestyle of consumers these days. Another major factor driving the market's growth is the increasing demand for fast food among consumers from all age groups. It leads to a high level of automation in warehouse activities, enabling efficient handling and time-saving techniques. The growth of e-commerce companies and platforms also helps the development of automation in the food warehousing market.

The meat, poultry, and seafood segment is expected to grow with the highest CAGR in the forecast period due to the high demand for such products by consumers. Efficient cold storage technologies to handle the storage of such products, managing temperature settings for each product, and avoiding cross-contamination for food safety also help the growth of automation in food warehousing market in the foreseeable period. The segment has also observed growth due to enhanced food safety, improved automation, and efficiency in various warehouse tasks.

End Use Type Analysis

The food manufacturers segment led the automation in the food warehousing market in 2024 due to increasing pressure on storage for food manufacturers. The industry also has to pay attention to efficient, safe, and automated storage warehouses for handling the products safely and efficiently. Automated warehouses equipped with technologies such as AI, ML, IoT, RFID tags, sensors, and other methods facilitate the easy management of food products, along with their careful handling. The technological methods also help to lower dependence on manual labor, along with managing rising labor costs.

The e-commerce grocery platforms segment is expected to grow in the foreseeable future. High demand for groceries in the e-commerce segment helps the growth of the segment, further fueling the growth of automation in the food warehousing market. The shift towards the online segment for enhanced convenience and changing consumer demands further fuels the demand for automated warehousing activities. It helps to manage groceries easily, along with safe and efficient handling. Automated technologies also ensure that groceries are safe, fresh, and not spoiled, and are handled efficiently.

Deployment Mode Analysis

The on-premises segment led the automation in food warehousing market in 2024 as the segment aids more control over installation, power, and easy management. It also helps to aid infrastructure that is helpful for organizations with strict management. The on-premises segment also enables personalized services for managing software and warehousing activities, which may not be possible with e-cloud services.

The cloud-based segment is expected to grow over the forecast period, which is beneficial due to lower initial investment, easy integration, and enhanced vendor security. The cloud-based data allows for easy accessibility from any device, such as a desktop or even a smartphone. The use of cloud-based services enables manufacturers to manage data efficiently, resulting in enhanced productivity.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- India Flavored Milk Market: The India flavored milk market size is forecasted to expand from USD 345.96 million in 2025 to USD 560.13 million by 2034, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Soybean Seed Market: The global soybean seed market size is projected to expand from USD 11.37 billion in 2025 to USD 21.09 billion by 2034, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

- Wheat Protein Market: The global wheat protein market size is forecasted to reach from USD 7.69 billion in 2025 to USD 11.43 billion by 2034, expanding at a CAGR of 4.5% during the forecast period from 2025 to 2034.

- Gummy Supplements Market: The global gummy supplements market size is expected to grow from USD 7.29 billion in 2025 to USD 13.63 billion by 2034, at a CAGR of 7.2% over the forecast period from 2025 to 2034.

- Pulse Ingredients Market: The global pulse ingredients market size is forecasted to expand from USD 23.24 billion in 2025 to USD 30.86 billion by 2034, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

- Essential Oil Market: The global essential oil market size is expected to grow from USD 28.24 billion in 2025 to USD 61.83 billion by 2034, at a CAGR of 9.1% over the forecast period from 2025 to 2034.

- Compound Feed Market: The global compound feed market size is expected to grow from USD 614.57 billion in 2025 to USD 986.58 billion by 2034, at a CAGR of 5.4% over the forecast period from 2025 to 2034.

- Bakery Premixes Market: The global bakery premixes market size is forecasted to expand from USD 456.8 million in 2025 to USD 763.2 million by 2034, growing at a CAGR of 5.96% during the forecast period from 2025 to 2034.

- Sweeteners Market: The global sweeteners market size is forecasted to expand from USD 113.17 billion in 2025 to USD 156.26 billion by 2034, growing at a CAGR of 3.65% during the forecast period from 2025 to 2034.

- Functional Food Ingredients Market: The global functional food ingredients market size is forecasted to expand from USD 127.48 billion in 2025 to USD 232.40 billion by 2034, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Top Key Players in the Automation in Food Warehousing Market:

- Dematic - Global integrator offering AS/RS, conveyors, AGVs/AMRs, and software, particularly strong in cold chain and food fulfillment optimization.

- Daifuku Co., Ltd. - Japanese leader in automated material handling systems and conveyor/sorter technologies, supplying food, e-commerce, and manufacturing industries globally.

- Swisslog Holding AG - Offers temperature-controlled warehouse automation, AS/RS, robotics, and software for food & beverage, with strong emphasis on energy efficiency and modular, scalable designs.

- Honeywell Intelligrated - Provides conveyor, sortation, AS/RS, robotics, and controls/software solutions with strength in integrated material handling for distribution centers (including food).

- SSI Schäfer - Offers a full suite of intralogistics solutions (storage, racking, automation) with the ability to deliver large-scale, customized food & beverage warehousing systems.

- Murata Machinery - Japanese manufacturer known for reliable, high-quality conveyor and handling systems used in food & beverage and other sectors.

- Vanderlande Industries - Specialises in automated sortation, Goods-to-Person robotics, and AS/RS with scalable, adaptive configurations for large warehousing and food/logistics operators.

- Knapp AG - Austria-based provider of intralogistics automation, including shuttles, robotics, and software; works with grocery, retail, and 3PLs to modernize fulfillment operations.

- Blue Yonder (JDA Software) - Software-focused, delivering WMS / supply chain planning and optimization, demand forecasting, and inventory control to support automated warehouses.

- Zebra Technologies - Known for sensors, barcode / RFID technologies, mobile computing, and scanning hardware, central to traceability, picking, and inventory in food warehouses.

- GreyOrange - Specialises in autonomous mobile robotics (e.g., “Butler” robots) and AI-driven goods-to-person systems for order fulfillment in high SKU variability environments.

- Locus Robotics - Provides AMRs that work collaboratively with human pickers, enabling rapid deployment of picking/putaway automation without major infrastructure change.

- Fetch Robotics - Offers flexible AMR robotics and cloud/software tools for automating repetitive transport, picking, and movement tasks within warehouses.

- Amazon Robotics - Pioneered swarm robotics / pod-based shelving systems (formerly Kiva) to move storage units to pickers, achieving very high throughput in Amazon’s fulfillment operations.

- Mecalux - Spanish storage and racking specialist integrating AS/RS, shelving, shuttle, and racking systems, often in highly dense storage settings, including food/ambient goods.

- AutoStore - Robotised small parts storage and picking system using cube storage/robots on top layers, ideal for high-density / small-parts / ambient, faster order pick environments.

- Symbotic - Combines robotic storage & retrieval and automated inventory/sortation/robotics with software to support large-scale, high-throughput warehouses (often food / CPG customers).

- Körber AG - Software and solutions provider (WMS, supply chain, automation integration) with a broad portfolio across multiple sectors, supporting automated fulfillment and cold chain environments.

- Elettric80 S.p.A. - Specialised in automatic material handling, robotics, and system solutions (including pallet, case handling) with a focus on logistics automation in food & beverage and retail.

- Bastian Solutions - US-based integrator of material handling/automation systems, robotics, conveyors, and sortation, supporting food & beverage customers via turnkey and modular automation solutions.

Segments Covered in the Report

By Technology Type

- Automated Storage & Retrieval Systems (AS/RS)

- Conveyor & Sortation Systems

- Robotic Picking & Packing

- Automated Guided Vehicles (AGVs)

- Warehouse Management Systems (WMS)

- Internet of Things (IoT) & Sensors

- Artificial Intelligence (AI) & Machine Learning (ML)

- Drones & Aerial Monitoring

By Warehouse Type

- Cold Storage Warehouses

- Ambient Food Warehouses

- Dry Storage Warehouses

- Distribution Centers

- Fulfillment Centers

By Application

- Inventory Management

- Order Picking & Fulfillment

- Palletizing & Depalletizing

- Packaging & Labeling

- Receiving & Shipping

- Quality Inspection

- Temperature Monitoring

By Food Type

- Dairy Products

- Fruits & Vegetables

- Meat, Poultry & Seafood

- Packaged & Frozen Foods

- Bakery & Confectionery

- Beverages

By End-Use

- Food Manufacturers

- Retail Chains & Supermarkets

- Third-Party Logistics Providers (3PLs)

- E-commerce Grocery Platforms

- Foodservice Distributors

By Deployment Mode

- On-Premises

- Cloud-Based

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5730

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Organic Food Market: https://www.towardsfnb.com/insights/organic-food-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dietary Supplements Market: https://www.towardsfnb.com/insights/dietary-supplements-market

➡️Plant-Based Protein Market: https://www.towardsfnb.com/insights/plant-based-protein-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Yogurt Market: https://www.towardsfnb.com/insights/yogurt-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️ Food Additives Market: https://www.towardsfnb.com/insights/food-additives-market

➡️ Baking Ingredients Market: https://www.towardsfnb.com/insights/baking-ingredients-market

➡️ Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️ Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Dairy Processing Equipment Market: https://www.towardsfnb.com/insights/dairy-processing-equipment-market

➡️Meat Products Market: https://www.towardsfnb.com/insights/meat-products-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Seed Coating Materials Market: https://www.towardsfnb.com/insights/seed-coating-materials-market

➡️Precision Fermentation Market: https://www.towardsfnb.com/insights/precision-fermentation-market

➡️Pet Dietary Supplements Market: https://www.towardsfnb.com/insights/pet-dietary-supplements-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.